Content

Statista Research Department顯示,16年來英國樓價超過60%

1. 什麼是英國HMO

AccordingUK government's official websiteHMO (House In Multiple Occupation) refers to a property that is rented out to at least three people who are not from the same family, and who need to share facilities such as the kitchen or bathroom. HMOs are typically rented by single working individuals, students, or people under government protection.

In the UK, one common form of rental property is the HMO, where a unit is divided into several rooms for rent. Therefore, it is sometimes referred to as a "shared house" or "divided rental property". Simply put, it's similar to what's often called "subdivided housing" in Hong Kong. The rental income from HMOs is typically higher than that from general rental properties, making the return on investment more attractive. However, there are stricter rental regulations for HMOs that property owners must adhere to. Therefore, it's crucial to fully understand these before investing in HMO properties to avoid falling into property buying traps!

2. 回報、流行原因、優點及缺點

HMOs in the UK have emerged as a popular new investment trend in recent years. As an international city, the UK continually attracts new immigrants, students, entrepreneurs, young professionals, and refugees. Due to high national property prices, many people prefer to rent more affordable HMOs. Seeing this trend, the government has begun developing more HMOs, working together with companies like Mears, Serco, and Readyhome to fulfill their social responsibility of providing affordable housing for the public.

|

Pros |

Cons |

|

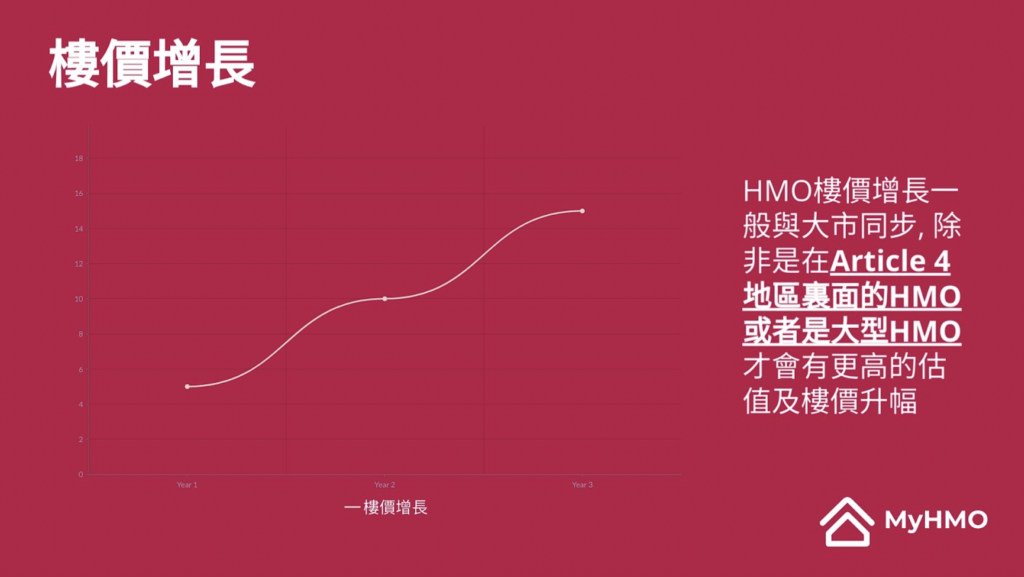

UK property prices have seen steady growth over the past 10 years According to Statista, the average property price (including HMOs) in the UK has grown by over 5% annually in the past 10 years. |

Stricter rental regulations Due to safety concerns, HMOs in the UK are regulated by the government. Owners of HMOs housing five or more people are required to have a license. The construction of these properties also needs to comply with regulations, which are stricter than those for buy-to-let properties. |

|

The investment threshold for HMOs is low The investment threshold for HMOs is low, with as little as £150,000 required to own an HMO property, which has considerable growth potential. |

Maintenance and operational costs Since HMOs have higher construction requirements than regular properties and need more tenants, owners will inevitably face higher costs for renovation and modification. |

|

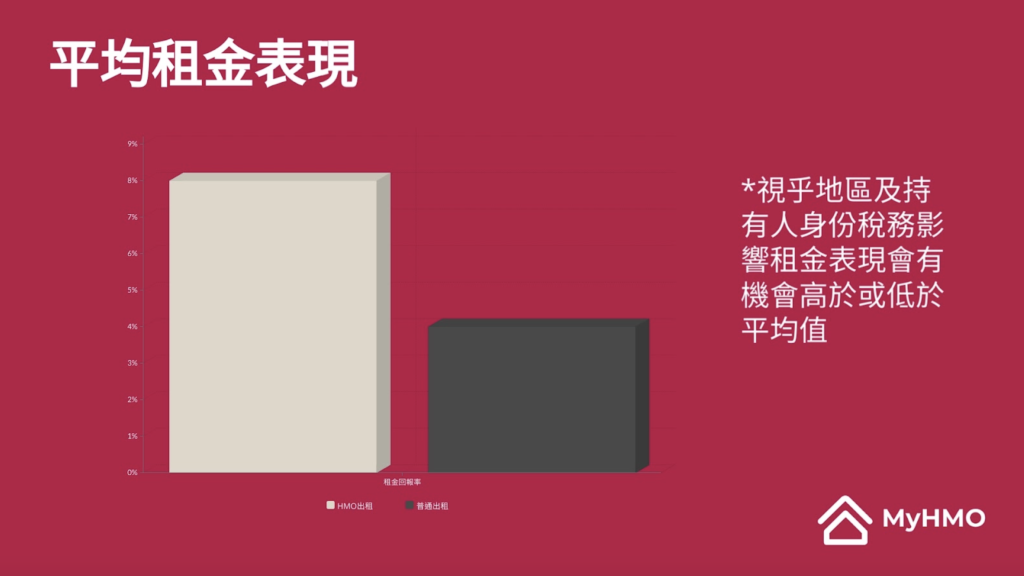

The rental income is relatively stable and the returns are high Compared to a 4% p.a. yield for Buy-to-Let (BLT), the average annual yield for UK HMOs is 7.5% p.a., and in specific areas like Carlisle, it can even reach a net annual interest rate of 9%. Let's look at some examples of HMO rental income. |

Tenant turnover is unstable Given the larger number of tenants, property owners may need to handle more move-in and move-out situations. |

|

Shorter void periods / Higher rental income Since the unit can be rented to different tenants, investors have greater flexibility in letting the property, effectively avoiding and shortening the vacancy period for the entire property. |

Professional consultancy is required The aforementioned drawbacks can deter many prospective owners from purchasing HMOs. However, if you choose MyHMO's comprehensive service, we can help you easily achieve stable returns. |

💡How does MyHMO.io's comprehensive service help you maximize your HMO investment value?MyHMO is one of the very few companies in Hong Kong that specialize in UK HMO acquisition and investment. Our team of experts has 18 years of property investment experience and can guarantee you stable returns. |

3. 針對以上,MyHMO如何助你賺得穩定回報 (3大保證+1條龍服務)

By choosing MyHMO's comprehensive service, we can help you easily achieve stable returns. From property selection, to renovation, and post-rental support, our knowledge and network can help you earn stable returns. We offer the following benefits:

-

Guaranteed compliance with government requirements (18 years of experience, exclusive property information across Hong Kong)

We're UK property sourcing agents, with 18 years of experience, have in-depth and exclusive UK property resources. We can find UK properties at low market values, delivering higher than average market returns for buyers. When renovating to become a UK HMO, we follow up on the project to ensure the property renovation complies with the UK government's regulations for HMOs.

-

Guaranteed tenant source (5-7 years of guaranteed rental income)

As UK government social housing agencies lease for a term of 5-7 years, MyHMO, being a partner of Mears, ReadyHome, Serco, and other UK HMOs, can guarantee a stable source of tenants.UK Government Housing Association,ensuring that your property finds tenants

-

Guaranteed returns (generating stable rental income with net rental returns of over 8%)

We specialize in operating UK HMO properties with the highest potential for appreciation and rental returns. With an investment starting from just £150,000, property investors can start generating stable rental income with net rental returns of over 8%. Once approved, the largest UK government housing agencies (such as Serco, Readyhome, Mears) will arrange the lease and sign directly with the property owner. After signing, the next month's rent will be received.The rent is automatically transferred to the owner's UK bank account each month.。

-

Comprehensive service (from purchasing to renovation to rent collection, we help you generate passive income in 4 months)

From purchasing a UK HMO property to establishing a company, tax planning, arranging for a lawyer, mortgage loan, rental management, and selling the property, we provide comprehensive property investment management services to help investors build and expand their property portfolio.

4. 投資程序:買入及裝修改建流程,需時4個月

Step |

Time required |

||

1 |

一對一諮詢:

|

~7-14 Days |

|

2 |

Project Screening:Provide HMOs that can achieve target returns for buyers to reference and select the most satisfactory project. |

~7-10 Days |

|

3 |

成交:Arrange for a lawyer to handle the property transfer process and AML (Anti-Money Laundering) Check. |

~28 Days |

|

4 |

成為業主:After the owner receives the property, we will immediately arrange for renovation works. |

~3 Days |

|

5 |

進行裝修工程:Our project manager will be responsible for supervising the work to ensure that the specifications of the HMO property meet the standards of the city government and housing agency. |

~60 Days |

|

6 |

安排房屋機構檢查:During the construction process, and when the work is nearing completion, we will arrange for relevant government officials to inspect the property to ensure that everything is completed according to their specifications. |

~7 Days |

|

7 |

簽署租約:After passing the inspection, the agency will arrange a lease and sign it directly with the owner. After signing, the rent will be automatically transferred to the owner's UK bank account every month starting from the next month. |

||

💡Are there any examples of investing in UK HMOs for reference?MyHMO will share two customer investment examples below to give you a glimpse into the real situation of investing in UK HMOs! |

5. HMO出租規例:牌照、監管條例、業主責任

HMOs have stricter regulations compared to traditional rental properties (Buy-To-Let).Regulatory requirementsIncluding:

I. HMO牌照

HMOs usually need to be permitted by the local council to be legally rented out, and whether a license is required depends on the scale of the HMO property and local laws.

A. HMO牌照分為3類:

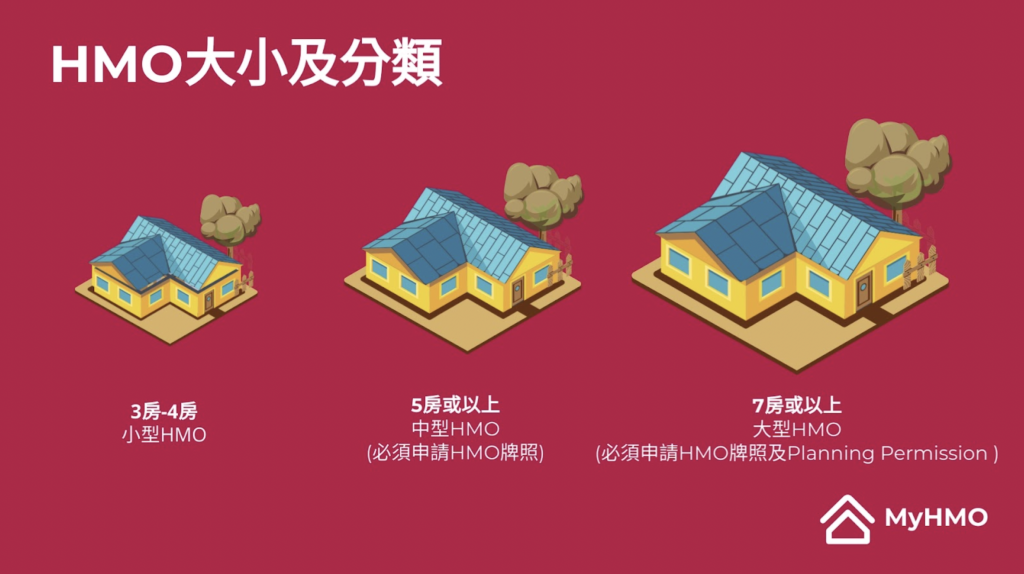

1. 強制牌照(Mandatory Licensing)Properties with 5 or more tenants (from 2 different households) must obtain a mandatory license.

2. 附加牌照(Additional Licensing): Different local councils can set licensing requirements according to different HMO scales. Because it is not a nationwide mandatory license, it is called an additional license. If the HMO is located in an area that implements an additional license, a license is required even for fewer than 5 tenants.

3. 選擇性牌照(Selective Licensing):市政府亦可以對某些地區(如街道或選區)推行牌照要求。如HMO位於推行選擇性牌照地區,HMO物業同樣需要取得牌照。

B. 申請牌照時,政府會評估以下設施:

- Appropriate fire safety equipment installed in the kitchen, including smoke alarms and heat detectors.

- The property holds a gas safety certificate.

- Completion of an Electrical Installation Condition Report (EICR), rated as a safe level.

- The property does not exceed the reported number of residents.

- Providing suitable cooking and daily cleaning facilities for tenants.

- Common spaces are properly maintained and cared for.

- Providing sufficient trash bins.

💡Do I need to apply for an HMO license?If your unit meets the conditions for a mandatory license, that is, it has at least 5 tenants from two or more different households, you must obtain an HMO license. However, if the area implements additional or selective licensing, even if your HMO property is smaller in scale (i.e., fewer than 5 tenants), you may still need to obtain a license. |

C. HMO牌照費用HMO牌照費用及有效期

The cost will depend on: local council charges, the number of HMOs owned by the manager, and the size of the HMO. The license fee may range between £300 and £2,000. Most local councils will publicly display the licensing fees on their official websites for easy reference, such as the Bolton Council.HMO License Feesfor reference

Most HMO licenses are valid for 5 years and need to be renewed upon expiry. However, some local councils also offer licenses with shorter validity periods.

II. 租客健康及物業安全

A. HMO跟其他私人出租物業相同,受英國健康和安全法例所規管,意味業主必須:

- Conduct an annual gas safety assessment.

- Carry out an Electrical Installation Condition Report (EICR) every 5 years.

- Comply with fire safety and smoke/carbon monoxide alarm rules.

- Ensure that the energy efficiency standard meets the minimum requirements (Minimum Energy Performance Certificate Rating).

- The government will notify landlords or conduct surprise inspections of HMO properties for safety and tenant health compliance with legal requirements within 5 years of receiving the HMO license application, conducting a Housing Health and Safety Rating System (HHSRS) assessment.

B. 房間大小

- The sleeping space for a single tenant should be at least 6.51 square meters.

- The sleeping space for two tenants should be at least 10.22 square meters.

- These are national standards, but local councils have the right to impose stricter requirements on the above limits.

C. HMO房間亦規定

- A maximum of two people can stay in any room.

- Rooms can only be shared if both the landlord and the tenant agree.

III. 規劃許可 (Planning Permission)

If landlords want to convert their property into an HMO, they need to be aware of the planning category. Standard residential properties fall under the C3 planning category, while HMOs accommodating 3-6 people fall under the C4 category.

To rent out for C4 use from C3, it depends on whether the property is located within an Article 4 area. If the property is not located within the area, there is no need to apply for additional planning permission. However, if the property is located within an area with Article 4 and is to be expanded and remodeled into an HMO, such as changing a standard 3-bedroom terraced house into a 4-5 bedroom HMO property, the landlord must obtain planning permission from the local government. Any HMO that can accommodate 7 people or more belongs to a special planning category (Sui Generis), and planning permission must be obtained regardless of the area.

IV. 消防規定

A thorough fire risk assessment should be conducted before renting out an HMO. The fire regulations for HMOs include:

- Fire doors that close automatically must be installed at every entrance to bedrooms, living rooms, and kitchens.

- All fire doors must meet a 30-minute fire resistance requirement.

- There should be clear fire escape windows.

- Provide fire escape routes.

- Display emergency exit signs and notifications.

- Install mains-powered smoke alarms.

- Install heat detectors in the kitchen.

- For large HMOs with longer or more complex escape routes, an emergency lighting system needs to be installed.

- Fire extinguishers and fire blankets.

V. 管理規定

Before issuing an HMO license, the licensing department will assess whether the landlord is a "fit and proper person," meaning they have not previously violated any criminal law, housing law, or landlord/tenant law.

6. 英國HMO稅項、按揭/貸款及保險及其他注意事項

A. Understanding UK Property Taxes (Value Added Tax x Income Tax x Stamp Duty)

I. 薪俸稅

In the UK, rental income is considered income and is subject to UK income tax. The UK uses a progressive tax rate, where the higher the income, the higher the tax rate. According to the latest guidelines in 2023, the UK's individual income tax rates are as follows:

- Basic tax-free allowance is £12,570 or below: 0%

- The basic tax rate for £12,571 – £50,270 is 20%

- The higher tax rate for £50,271 – £125,140 is 40%

- Additional tax rate for £125,140 or above: 45%

II. 增值稅(VAT)

In addition, the UK also charges Value Added Tax (VAT) on products and services, usually 20%. In certain circumstances, such as during HMO conversion work, a special reduction can be obtained, only requiring a 5% VAT payment, and it can be accounted for in the company's expenses.

When selling a property, the UK's capital gains tax depends on the individual's income level and is required to pay 18% or 28% tax. If the annual income is at the basic tax rate or below, only 18% tax needs to be paid, but if the annual income is at the higher tax rate or above, 28% tax needs to be paid.

III. 政府稅(Council Tax)

Other property-related taxes include the UK Council Tax. If the property is owner-occupied or vacant, it is the responsibility of the owner to pay. However, if the property is rented out, it is the tenant's responsibility to pay.

IV. 印花稅(Stamp Duty)

This tax is paid when purchasing real estate. If you are buying your first home for yourself, and it is worth no more than £250,000, you do not need to pay stamp duty. But for investment properties, the impact of stamp duty needs to be considered. For UK residents, if the purchase value of the property is less than £250,000, a 3% stamp duty is required; if the value is between £250,000 and £925,000, a 5% stamp duty is required, and so on. For non-UK residents, or overseas buyers, an additional 2% stamp duty is required, even if the purchase value is only £250,000.

💡 How to confirm the taxes involved in an investment?In conclusion, understanding the UK tax system is very important before investing in UK property. Different taxes involve different ranges and tax rates, and the impact of each tax needs to be carefully considered. If you need more information about the UK tax system, it is recommended that you contact a professional UK accountant for assistance. |

B. 按揭/貸款

HMOs are also subject to other rental property laws, includingHMO Mortgage LoansHMOs require specialized mortgage loans and cannot be financed through ordinary property mortgage loans. HMO mortgage loans typically have stricter lending standards and higher interest rates.

C. HMO保險

A. 購買建築保險(Buildings Insurance):

此為購買英國HMO最重要的保險。建築物保險主要承保對物業結構造成的任何損壞,覆蓋物業所有基本組成部份,包括廚房、浴室配件等。

Policies typically cover the following types of damage: theft, deliberate damage, malicious damage, natural disasters, and even subsidence accidents.

B. 家居財物保險(Contents Insurance):

保障室內家具損毀

C. 租金保證保險(Rent Guarantee Insurance):

如租客拖欠租金,保險可補貼業主一段時間內的租金,通常最長可達6個月

D. 公共責任保險(Public Liability Insurance):

如果租客在HMO內受傷,可保護業主免於承擔責任

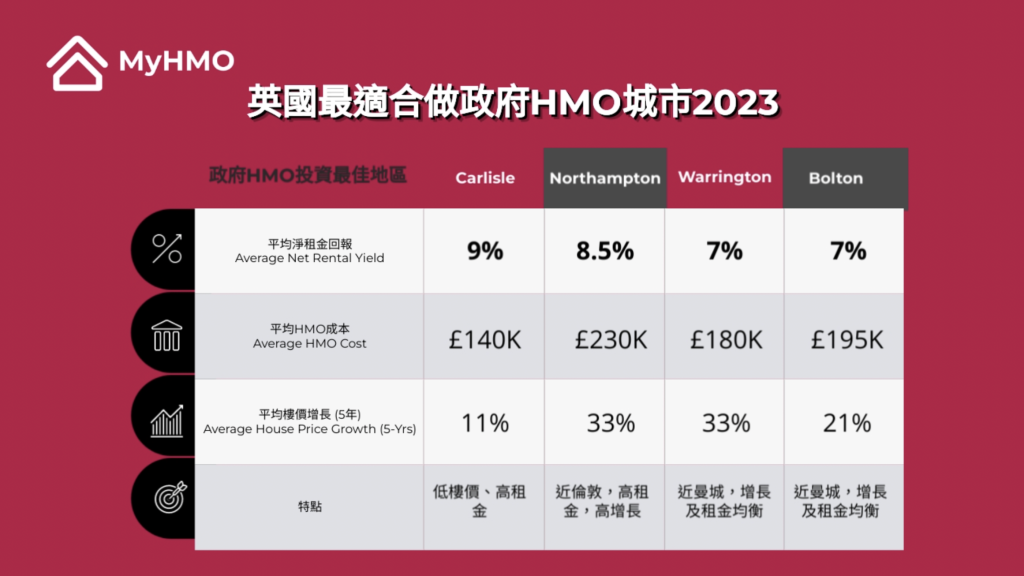

D. 地區及單位選擇 (Click here to learn more about the most suitable cities in the UK for HMOs)

-

Carlisle

-

-

- Features: Low property prices, high rents

- Average net rental return: 9%

- Average HMO cost: £140,000

- Average property price growth: 11%

-

-

Northampton

-

-

- Features: Near London, high rent, high growth

- Average net rental return: 8.5%

- Average HMO cost: £230,000

- Average property price growth: 33%

-

-

Warrington

-

-

- Features: Near Manchester, balanced rent and growth

- Average net rental return: 7%

- Average HMO cost: £180,000

- Average property price growth: 33%

-

-

Bolton

-

- Features: Near Manchester, balanced rent and growth

- Average net rental return: 7%

- Average HMO cost: £195,000

- Average property price growth: 21%

7. 真實個案研究

Below, we analyze two examples of UK HMO investments by our clients. It can be seen that the investment has great potential in terms of rent, potential for price increase, and management costs:

A. 例子一:Eric Wong,2023 四月購入

Location: : Montreal Street, Carlisle CA2 4EE

Price: £131,000

Guaranteed Property Rental Return: 10.79% p.a.

Monthly Rent £1,178 PCM

Guaranteed Rent: £14,143 per year

Price increase in the area over the past 3 years (Land Registry: 13%)

Features:

- Obtained a 7-year lease provided by a government-approved housing agency, guaranteeing rental returns

- Tenants pay the rent on time every month via automatic bank transfer

- The housing agency covers all costs such as water, electricity, coal, and local government taxes

- The property will undergo a complete renovation to meet the requirements of the Housing Association HA

- Zero vacancies, zero management fees

B. 例子二:5 個年輕醫生的家

It is only a 10-minute walk from Salford Royal Hospital, so it can meet the needs of medical staff working in the hospital. All rooms were rented to a group of young doctors before the renovation was completed.

📌 Location: Kennedy Road, Salford (nearby Manchester City)

Price::£300,000

Guaranteed Property Rental Return: 12% p.a.

Monthly Rent: £45,000 PCM

Guaranteed Rent: £14,143 per year

Price increase in the area over the past 3 years (Land Registry: 18%)

Features:

- The golden triangle of Salford University, Salford Royal Hospital, and Media City

- HMO destination 10-15% rental yield depends on the purchase model and leverage

- HMO management costs are low, averaging an additional 10% with VAT

Before deciding to invest in UK HMOs, it is recommended to consider whether the cost and return of the HMO project are proportional. HMO properties require more management from the owners than typical residential properties, and hence offer higher returns. However, current inflation in the UK has led to an increase in the operating costs of HMOs, reducing the returns. Therefore, more and more HMO investors are choosing to rent their properties to the government to rent to Housing Associations, which can earn HMO rental returns while avoiding the need for active management and bearing operational expenses.