Table of Contents

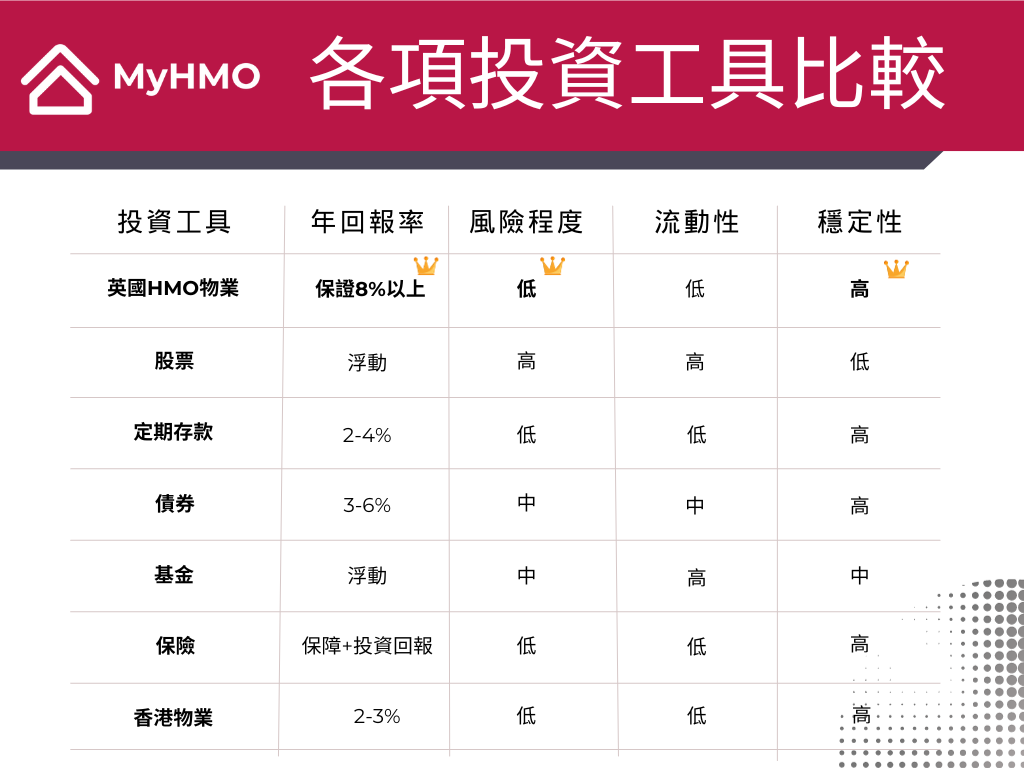

Why are more and more people choosing to buy property and collect rent in the UK? In this issue, we compare the passive income performance of the most commonly used investment tools by Hong Kong people, and analyze the advantages and disadvantages of UK HMOs compared to them!

The evaluation mainly focuses on four important factors

1) Annual return rate - The actual income that can be collected each year divided by the principal

2) Level of risk - The risk of losing the principal

3) Liquidity - The ease of converting assets back into cash by selling them

4) Stability - The stability in achieving the annual return rate

Stocks

When it comes to investing, Hong Kong people are all about stocks, which can be said to be one of the most popular investment tools. There are numerous channels to access stocks, such as online trading through brokerage firms and stock trading services provided by banks. The entry cost depends on the stock, but the minimum is just a few thousand dollars. However, easy access does not mean safety. In fact, stocks are a high-risk asset. The annual return on stocks is not guaranteed. Until the day the stocks are sold, the actual profit is still uncertain. Even if you buy dividend-paying stocks, the right to decide on the dividend is still in the hands of the company's management, who can reduce the dividend or even not pay it at any time! Those who bought HSBC stocks a few years ago would have a deep impression of this. Moreover, for some stocks that do not pay dividends, all investors can hope for is a steady rise in stock price. However, individual retail investors have no way to control the rise and fall of stock prices. Even if they invest in the "king of stocks", past performance does not represent future stock price performance. If the stock price keeps falling and there is no dividend, it is really heartbreaking.

The advantage of stocks is high liquidity (limited to large company stocks) and easy accessibility. However, the stability of the annual return rate is quite low. Stocks can skyrocket one year and plummet the next, and the stock market is very sensitive to external environmental factors. Some news can cause dramatic fluctuations. Therefore, it is not recommended for investors who plan to provide a stable monthly income through stocks, because the nature of stocks is at odds with the objective of stable income.

Fixed deposit

As the world enters a period of interest rate hikes, many banks are offering higher interest fixed deposits to attract funds. The interest provided varies depending on the bank and the currency. As of October 2023, physical banks in Hong Kong generally offer a fixed deposit interest rate of 2-4% per annum. The advantage of a fixed deposit is that it is considered a "risk-free interest rate". As the name suggests, funds generally deposited in banks do not face the risk of capital loss. However, fixed deposits offer higher deposit interest. During the fixed deposit period, funds cannot be used at will, so investors are effectively giving up the opportunity for their funds to earn higher returns, also known as opportunity cost. This means that when a quality investment opportunity appears, such as a very affordable property, but your funds are locked in a bank for a fixed term, you won't be able to make the purchase because your funds are locked by the bank. However, the advantage of a fixed deposit is its high stability. The bank will deposit the promised fixed deposit interest into your account upon maturity.

In addition to opportunity cost, you also need to consider whether the rate of inflation will exceed your fixed deposit interest. For example, if inflation is currently at 5% and you make a one-year fixed deposit with an interest rate of 4%, after one year when you retrieve your principal along with the interest, it appears on paper that you have earned a 4% interest, but your actual purchasing power has dropped by 1%. This is because the prices of goods around you have increased by 5% compared to when you made the fixed deposit a year ago.

Funds

Similar to stocks, a fund is managed by a fund company that is responsible for investing in a basket of stocks, bonds, or real estate. Fund managers charge annual management fees, and returns are not guaranteed. Fund dividends are also deducted from the unit value of the fund, so in fact, fund unit holders do not actually benefit, which is the same as selling some fund units for cash. Fund dividends are also decided by the fund management, and individual unit holders have no right to demand how much interest to distribute. At the same time, historical data shows that most fund managers underperform compared to indices, so many people question whether it is worth paying fund managers to actively manage. The annual return of funds is also variable, and investors also have the chance to lose their principal, depending on the liquidity of the fund you choose. But like stocks, funds have poor return stability.

Bonds

The popularity of bonds in Hong Kong is relatively lower than that of stocks or funds. Buying US Treasury bonds is safer, but the returns are lower. Unless you are purchasing investment-grade bonds issued by large companies, the risk is higher but the potential return is not as good as stocks. Therefore, the positioning of bonds is a bit awkward. The annual return rate is about 3-6%, depending on the institution behind the issued bonds you choose to determine the level of risk. If you invest in bonds issued by individual institutions, there is a chance of default, and the risk is also quite high. The secondary market liquidity is lower compared to stocks and funds, because bonds are not popular in Hong Kong. However, if the bond issuer does not default, then the interest promised by the bond is quite stable.

Insurance

Hong Kong is one of the regions with the highest per capita insurance coverage. There are various types of insurance available in the market, but generally speaking, insurance that includes an investment component consists of two parts: protection and investment returns. Insurance companies are mostly tightly regulated and control their asset-liability ratio, so they need to be highly stable because policyholders rely on them to pay out in the event of an accident. However, insurance has low liquidity because the policy is tied to the insured person, and there is no secondary market for resale. Policyholders can only withdraw the cash value within the policy, but often the cash value within the policy is zero for many years. This means that the premiums paid by the policyholders in the first few years are used by the insurance company for investment and to provide pure insurance, without any return. So it can only be seen as a protection purchase. Many years later, the insurance company will calculate a portion of its investment income into the cash value of the policy, but it's a drop in the bucket. Therefore, it's not worthwhile for investors who hope to provide a stable income for themselves through the cash value of the policy. Considering the time cost and the availability of other better investment tools, it's better to just buy pure insurance when purchasing insurance.

Hong Kong Properties

Buying property for rental income is a goal pursued by many Hong Kong people, but Hong Kong's property prices are among the highest in the world. The higher the property prices in a region, the lower the rental return. In Hong Kong, the annual rental return on property purchase is about 2-3%, and after deducting rates, management fees, and miscellaneous expenses, the actual rental return is even lower. So why is there such a keen interest in buying property despite such low returns? The main reason is that the interest rate environment has been low for many years, allowing prospective buyers to use low-interest mortgage loans. As long as they can save up for the down payment, they can enter the market. Coupled with the supply-demand imbalance in the local property market in the past, as long as they get on board, they can enjoy the wealth growth brought about by the leverage as property prices rise.

Real estate is a tangible asset, and the owner has full ownership rights, so the risk level of real estate investment is the lowest among all investment tools. The rent can be controlled, and unless there are rent dodgers, tenants have to pay rent every month, providing a very stable cash flow. Property is also an effective tool against inflation. Since the cost of labor and materials rises with inflation every year, there are fundamental factors supporting the steady rise in property prices. However, real estate also has its downsides, such as low liquidity. After all, larger assets have higher entry thresholds, but as long as there are transactions in the secondary market, there's no need to worry about not being able to convert properties back into cash. Investing in Hong Kong property is attractive due to the city's sound legal system, abundant job opportunities, high per capita income, and convenient public safety, making it a livable city that attracts a large population, driving up Hong Kong property prices. However, with the recent mass immigration of high-income individuals, the government's reluctance to withdraw harsh measures, and the increase in housing supply, there are concerns about whether there will be enough new population to support higher property prices, which also brings hidden worries for the future performance of the Hong Kong property market.

UK HMO Properties

Buying property for rental in the UK is also very popular in Hong Kong. The reason is that the UK and Hong Kong are closely related, and the UK's legal system is robust. The protection for property owners in property transactions is even better than in Hong Kong, and there are almost no restrictions on overseas buyers, making it an open and transparent free market. Additionally, the entry threshold for UK property prices is lower, allowing more investors to afford it. The UK is also a hotspot for immigration and higher education, so apart from pure investment, it can also satisfy the need for future relocation or study needs of the next generation to some extent.

The performance of rental income for UK properties depends on the region. For example, London, as the second largest financial city in the world, has property prices in Zone 1 that can compare with Hong Kong, so the rental return is similar to Hong Kong, with an average annual rental return rate of 2-3%. However, in areas outside of London, such as Manchester, the second largest city in the UK, the average annual rental return for ordinary rental properties can reach 4-5%, and the average property price only requires 200,000 pounds (about 2 million Hong Kong dollars).

If the property is converted into an HMO (House in Multiple Occupation - similar to what Hong Kong people understand as "subdivided housing"), and individual rooms are rented out to different tenants, the rent received by the owner can be double or more than that of ordinary properties. HMOs in the UK have been operating for many years, are regulated by the government, require a license, and have clear specifications. The main tenants are single working individuals or institutions. This type of tenant has a strong demand for competitively priced rooms and hopes that a single rent can cover all utilities for their place of residence. Therefore, the rental demand for HMO rooms is strong.

The rental return of general HMO properties can be as high as double digits, with an average annual gross rental return of 12-15%. However, the owner needs to bear all utility costs for the tenants, including internet fees, television license fees, maintenance costs, etc. Also, since there are multiple tenants, the owners need to spend more time managing, so they usually hire a professional property management company to help manage, which means they need to pay management fees. Therefore, the average annual net rental return is about 8%.

In the past, HMOs in the UK were more suitable for professional property investors because they required managing more tenants, which demanded higher experience in property management from the owners. However, in recent years, the demand for HMOs from institutional tenants has been increasing day by day. Their leases generally guarantee the term and rent for 5-25 years. During this period, owners only need to hand over their property to them for management and tenant placement. The institutional tenants will bear all operating expenses, such as management fees, utilities, non-structural maintenance fees, etc., and will promise to provide guaranteed rent each month. The owners do not need to bear any operating expenses or management, so the rental income is a net return. The rental return will vary depending on the region, but the average annual rental return can reach 8% or more.

The UK property market has had an average annual increase of 5% over the past decade, and like properties in other countries, it is an effective hedge against inflation. The advantages and disadvantages of investing in properties are also present in UK properties. For example, the rent is set and controlled by the owner, and the tenants should pay the rent to the owner each month. In addition, the UK's terraced houses, semi-detached houses, or detached houses are generally long leasehold (999 years) or freehold, which is different from many countries. In the UK, buyers can essentially own the property permanently. HMOs in the UK are the most effective and safest assets for investors who want to generate stable monthly passive income. The stability of rental income is high. Once the rent is set, tenants have to pay this amount of rent, and the annual return can be budgeted for. Properties also will not cause investors to lose their principal, unless the property market falls sharply and the owner needs to cash out urgently. Otherwise, with the rent from HMO properties, continuing to hold can recoup the principal in about 10 years, so the risk of losing the principal is low. The main disadvantage of investing in properties is the lower liquidity. The threshold is higher than other investment tools that can be easily accessed due to the amount involved, but the UK property prices are not high. For example, HMO properties in Manchester only require £250,000 to £300,000 (depending on the refurbishment specifications and the number of rooms). As Manchester is a popular city, this price is relatively high. If you choose to operate HMOs in other less popular cities, the lowest entry threshold for property prices is only about £100,000 (about 1 million Hong Kong dollars), and you can still receive more than 8% rent, so the second-hand market is also quite prosperous.