Whether UK's HMOs are good or not depends on what goals the investor is pursuing.HMO properties in the UK are like other properties in the UK, they are all a floor of a building, but HMO has its uniqueness. Therefore, if its features suit you, it is worth investing in; otherwise, it is not suitable.

We hope to list the most common factors that investors need to consider, to help buyers make decisions. There are several main factors to consider whether UK HMO properties are suitable for you:

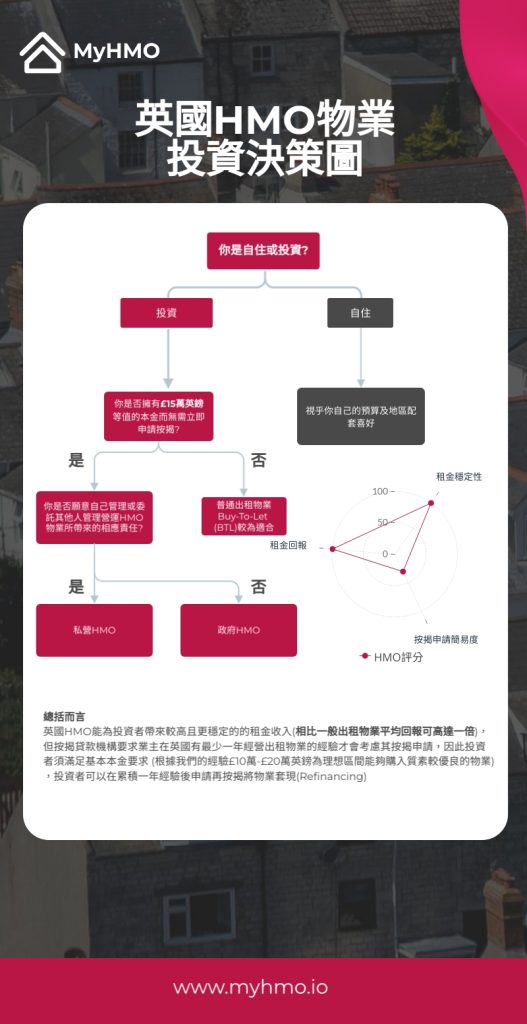

1) Self-occupancy or investment?

UK HMOs are mainly properties used for investment and rental purposes. The selection of the area, interior design, and partition planning are quite different from general properties. The main purpose is to make good use of the interior space of the property to create as many rooms as possible. This is because only rooms can be rented to tenants to generate rental income, and this method can greatly increase the rental income of the property. The interior decoration design depends on the target tenants. For example, if renting to a government housing agency, there is no need for "luxurious decoration". Overly high-specification decoration will only lead to increased costs and waste of resources. The selected area should have affordable property prices (higher rental returns), convenient transportation and living facilities for tenants to go in and out. As most HMO tenants are single individuals who hope to rent a room at a competitive price, there is no need for school networks and there is no need to be in expensive property districts, to avoid increasing the pressure of rent.

However, if you intend to use the property for your own use, you may not need so many rooms. Instead, you might prefer to have more shared space, or each room can be more spacious. The interior decoration can be more in line with your own taste, preferably in a high-quality school network or affluent area.

2) Cash purchase or need to apply for a mortgage?

nvestment as a more advanced property investment strategy. They usually require borrowers to have more UK property experience. For example, the most common requirement we see is that the property owner has at least one year of property rental experience in the UK before they are willing to approve the loan, or they will offer lower mortgage interest rates. If you do not have relevant experience but need to apply for a mortgage immediately to have sufficient funds, the interest will be very expensive and will eat up most of the rental profits. In this case, it is not recommended to do HMO.

UK HMO properties start at a minimum of £100,000 and can receive a rental return of over 8%.

If your available funds are less (less than £100,000), we would recommend you apply for a mortgage to purchase a general UK rental property (Buy-To-Let), or save until you can meet the minimum entry threshold conditions before considering investing in UK HMO properties.

3) Active management or passive management?

In the past, running a UK HMO always required active management. Even if a property management company was hired, because there are multiple tenants living in the same property, if they have any problems, the management company will eventually have to notify and contact the owner for his decision or pay for any maintenance issues. In addition, the owner is responsible for all utilities, council tax, Wifi fees, TV license fees, etc. for UK HMO properties. When inflation comes, the increase in costs will also increase the pressure to raise the rent. Therefore, UK HMO properties on the open market (meaning rented to individual tenants) are suitable for professional property investors or owners who do not mind spending time and effort to manage their HMO properties. Of course, HMO properties will provide more substantial rental returns as compensation, usually double the rent of ordinary properties.

In recent years, there have been more opportunities to rent HMO properties to government housing agencies or corporate tenants, and we are experts in this area. By leasing the entire HMO property from the agency tenants, owners have an option to passively manage their HMO properties, because the agency tenants will promise in the lease agreement to be responsible for managing and operating the entire HMO property. They must ensure the property is returned to its original condition when it is handed back to the owner, and they are responsible for all utility costs, etc. They receive the substantial rental income provided by the HMO property, but the owner has a stable monthly guaranteed rent as per the contract.

Conclusion:

UK HMO can bring higher and more stable rental income for investors (on average, it is twice as high as general rental properties), but mortgage lending institutions require property owners to have at least one year of experience in operating rental properties in the UK before considering their mortgage application. Therefore, investors must meet the entry capital requirement (based on our experience, £100,000-£200,000 is the ideal range to purchase high-quality HMO properties). After deciding to invest in UK HMO properties, you can also choose to rent on the open market to individual tenants and actively manage the property, or rent to government housing agencies and passively let them manage it for you.